Southern California Trust Administration Services

Trust Administration

If you’ve been named as a trustee, you may be feeling overwhelmed. Trust administration can be complex, and failure to take the proper steps can result in negative tax consequences or breach of your fiduciary duties. Fortunately, help is available in the form of trust administration services from an experienced attorney.

With our trust administration services, you can be confident that all the necessary steps will be taken to preserve favorable tax treatment and fulfill your fiduciary duties. We will work with you to understand the type of trust involved, any subtrusts, and the assets involved. We will also help you to minimize or eliminate estate taxes where possible.

Don’t try to navigate the complex world of trust administration alone. Contact us today and let us help you.

Trust Administration Process Checklist

Stage One

Stage Two

Stage Three

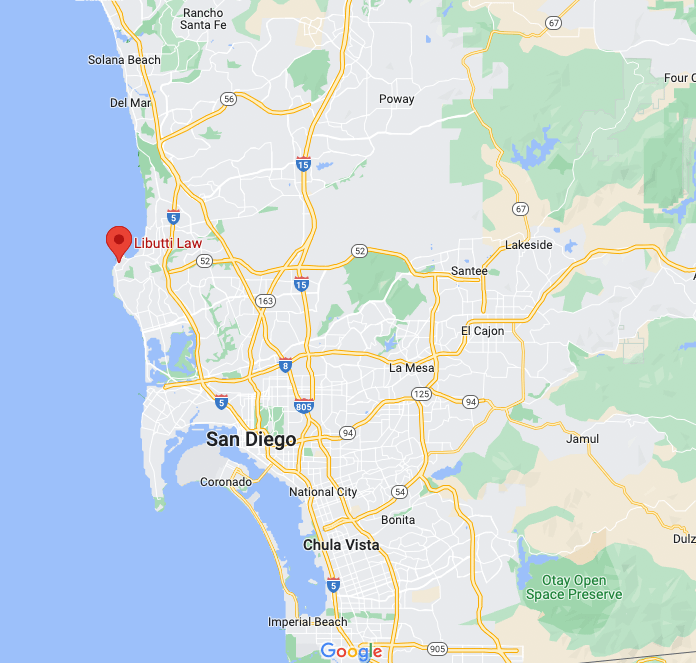

Serving Your Friends, Family, and Neighbors in and Around San Diego

- San Diego County: (858) 220-2806

- Chula Vista

- Oceanside

- La Jolla

- Escondido

- Carlsbad

- El Cajon

- Vista

- San Marcos

- Encinitas

- National City

- And more!